AI Fintech: Key Benefits and Use Cases

Explore AI FinTech trends, real-world use cases, and the bottom-line gains of artificial intelligence in FinTech for banks and financial technology platforms.

Table of Contents

Picture your risk team stuck on a 6-month chargeback. Analysts copy-paste data, and manual credit scoring delays new applications. Meanwhile, 67% of prospects quit after extra KYC questions. Faster AI FinTech competitors approve in under a minute and win the business.

Those six months illustrate how slowly legacy tools move, while the use of AI can clear the same dispute in days. It’s proof that you no longer need to fear AI taking jobs when it saves them instead.

In 2025, such delays are unacceptable in AI in financial services circles. AI scoring processes thousands of variables in milliseconds, and tools like Inscribe dramatically accelerate manual document review.

This speed is already live at top banks and neobanks. Instant decisions cut costs, prevent fraud, and keep customers loyal. This proves how tightly AI and FinTech now converge, showing why AI is revolutionizing the customer journey across the entire financial services industry.

Up next, we’ll learn where AI fits into the FinTech workflow, from credit, fraud, KYC, offers, churn, and to pricing, and what each upgrade does for the bottom line.

Key Takeaways

- Instant credit decisions. AI scoring approves worthy borrowers in under a second, lifts accuracy 5–7 points, and keeps your funnel moving.

- Streaming anomaly detection stops fraud without annoying customers. Models adjust thresholds on live data, cutting false positives and chargebacks in one stroke.

- LLM-driven KYC/AML turns compliance into a competitive edge. One SaaS endpoint slashes onboarding to minutes and wipes out late-filing penalties.

- Personalized offers land right when users are ready to say yes. Recurrent nets and clustering raise conversion while shrinking your ad budget.

- Churn forecasts buy you a 30-day head start on retention. Early alerts turn silent exits into win-back wins and grow LTV.

- Dynamic pricing learns what each segment will happily pay. Reinforcement learning adjusts fees on the fly, increasing commission revenue without harming loyalty..

- Case studies prove the model. Backbase cut release cycles by 14% with adaptive auth and CI, while Moments NFC trimmed checkout time by 40% and launched a multi-platform MVP in 12 days.

Where AI Hits the FinTech Pain Points

Your FinTech business might face pressure in credit scoring, fraud and AML checks, KYC onboarding, transaction monitoring, and cross-selling. Manual workflows slow approvals, waste engineering time on false positives, and drain marketing when offers miss the right moment.

AI turns gaps into profit centers. Across these processes, we already count dozens of use cases of AI delivering hard ROI. AML can save $3 trillion annually by cutting false alerts and analyst work.

Tools like GiniMachine cut defaults by 25% and boost approvals by 30%, proving that faster risk models unlock revenue. Similar gains show up in KYC, fraud, loyalty, and upselling as well. That upside is why many fintech organizations budget heavily for AI this year.

Next, we’ll break down each pain point one by one, with a concise recap of your engineering wins, including fewer tickets and cleaner data, and your business wins, like lower OPEX and higher LTV.

Lightning-Fast Credit Scoring with AI in Finance Industry

A headline application of AI in finance is lightning-fast scoring. It’s also among the highest-impact applications of AI in FinTech. Gradient-boosting models and deep neural nets sweep through thousands of signals like transaction history, social media, and even geodata, and deliver a verdict in under a second.

Continuous learning boosts accuracy by 5–7 percentage points and reduces unnecessary rejections, allowing clean approvals to roll in while rivals still shuffle paperwork. This illustrates mature FinTech machine learning in action.

Benefits for your engineers: One endpoint handles scoring. Risk logic moves out of scattered SQL and into a self-updating model, eliminating pipeline hassle and context switching.

Benefits for your business: Instant approvals reduce funnel drop-off, sharper models decrease charge-offs, and faster yes-decisions enhance customer satisfaction and lifetime value. Beyond risk, AI offers deeper insights for pricing and product design.

Real-Time Fraud Detection for Financial Technology and Banking

Fraud detection is one of the clearest examples of AI for financial services. Autoencoder and Isolation Forest models watch every payment in milliseconds, flagging impossible geolocations, out-of-pattern spends, or device overlaps before the transaction clears.

Retraining on live data shifts thresholds on the fly, ending hard-coded scores and catching fraudsters before they switch tactics.

Benefits for your engineers: Thresholds and rules now live inside the ML pipeline, refresh automatically after each retrain, and appear on one dashboard — no manual deploys or scattered SQL alerts.

Benefits for your business: Fewer false positives keep legitimate customers spending, while earlier fraud blocks cut chargebacks and fees, boosting trust and protecting revenue.

Instant KYC & AML: AI Applications in Finance

A FinTech AI now scans a passport image, extracts data in a single pass, checks it against global watchlists within seconds, and stamps “verified” straight into your CRM with no re-keying or follow-ups.

Benefits for your engineers: A single SaaS endpoint combines OCR and NLP, allowing you to retire brittle document templates and retrain the model instead of patching scripts.

Benefits for your business: Customers verify in minutes, late-filing penalties disappear, and revenue flows as competitors upload PDFs.

Hyper-Personalized Offers: Machine Learning for FinTech

This is advanced business intelligence for FinTech marketers. Recurrent nets analyze every tap, while clustering finds like-minded spenders.

The model offers a lounge upgrade during travel weeks and a credit line boost right after payday, right when the “yes” rate peaks, turning each journey into a standout FinTech experience.

And it can also act like a smart AI assistant for your CRM.

Benefits for your engineers: A gRPC microservice returns the best offer and its 28 % acceptance rationale, replacing hand-built SQL rules and weekly campaign edits.

Benefits for your business: Conversions rise and ad spend drops as messages reach warm leads, boosting lifetime value with tailored offers.

Predictive Customer Churn in FinTech AI Companies

CatBoost is a flagship case of AI in financial software development. It tracks every swipe, ticket, and login gap to flag customers likely to churn up to 30 days early. It streams scores into your data warehouse, allowing product managers to monitor risk in real-time on familiar dashboards. No extra SQL or exports needed.

This early warning helps you launch win-back campaigns before it’s too late. Retention pays off across the broader financial technology sector.

Benefits for your engineers: The churn model delivers a live score through a single data-warehouse table, eliminating ad-hoc scripts and pipeline maintenance.

Benefits for your business: Timely retention nudges cut churn, preserve revenue, and lift each customer’s lifetime value.

Quick Tip: Retention starts inside. Use these 13 steps to reduce employee turnover and keep morale high.

Dynamic Pricing & Fees: AI for FinTech Revenue Growth

Dynamic pricing ranks among the highest-ROI FinTech use cases. Reinforcement-learning agents test thousands of fee combinations every hour, fine-tuning prices by segment. VIP traders see lower spreads during peak hours, while late-night micro-payments carry small, unnoticed fees.

The model continuously balances revenue and churn, evolving long-term margins and freeing staff to focus on creative work instead of rote tasks, just as AI logistics frees operators from manual planning.

Benefits for your engineers: Pricing logic evolves from fragile if-else branches to a trainable policy activated by a simple A/B flag, eliminating the need for hand-tuning rate tables.

Benefits for your business: Commission revenue rises without denting customer loyalty, giving you elastic pricing power that adjusts in real time.

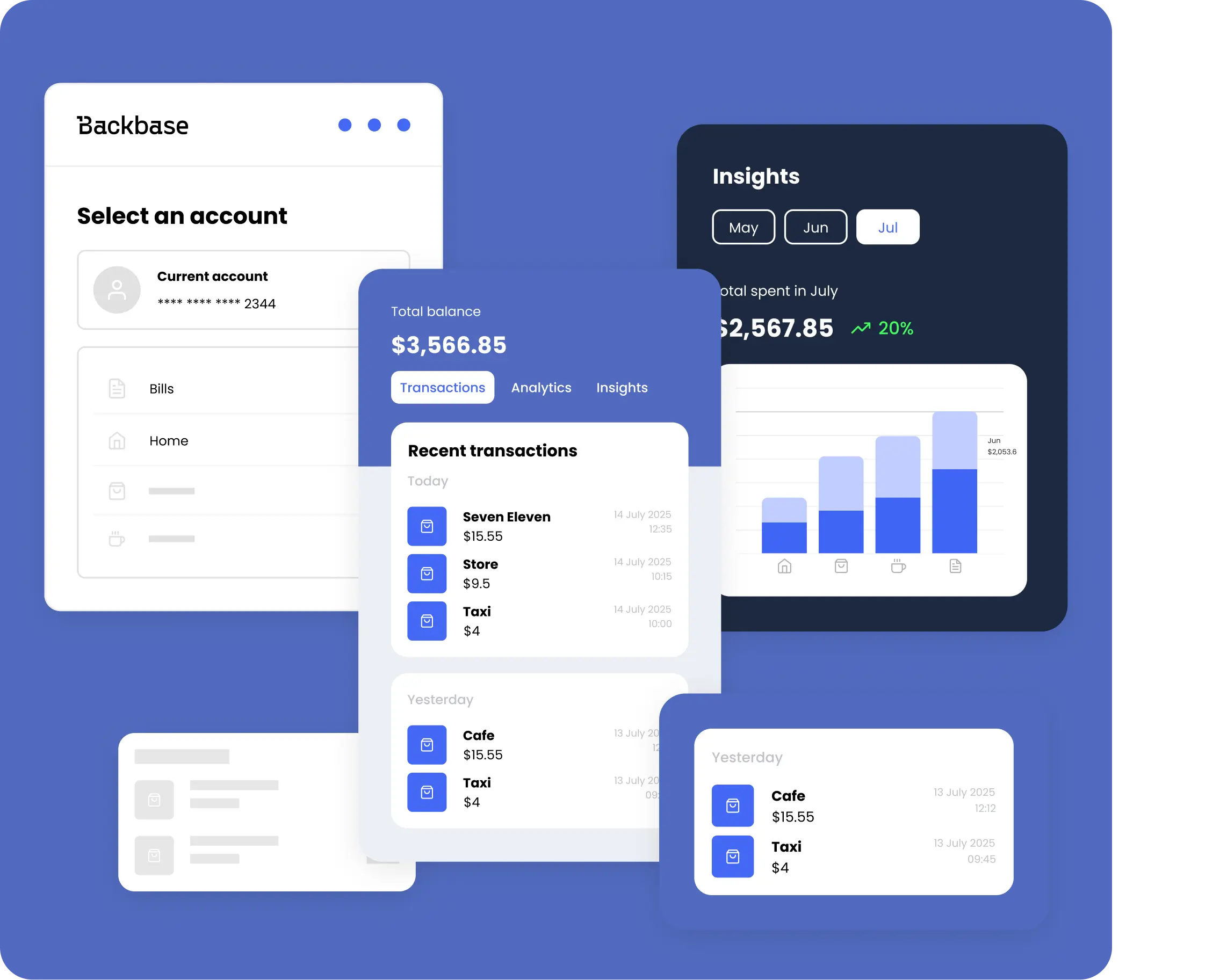

Backbase: Enterprise-Grade Artificial Intelligence FinTech Solution

Backbase tasked our team with creating a banking app tailored to each partner bank, with strong security and rapid feature delivery. We expanded the team from two specialists to a full unit and implemented AI-powered CI pipelines and a configurable authentication engine.

Choosing a stack? Review 9 reasons Ruby on Rails is perfect for SaaS before architecting your own FinTech app.

Challenges

Rolling out a secure, white-label banking app for partner banks came down to four key challenges:

Results

Clearing those hurdles helped Backbase onboard partner banks faster, secure regulatory approvals sooner, and release new features with less effort. Here are the results now in production:

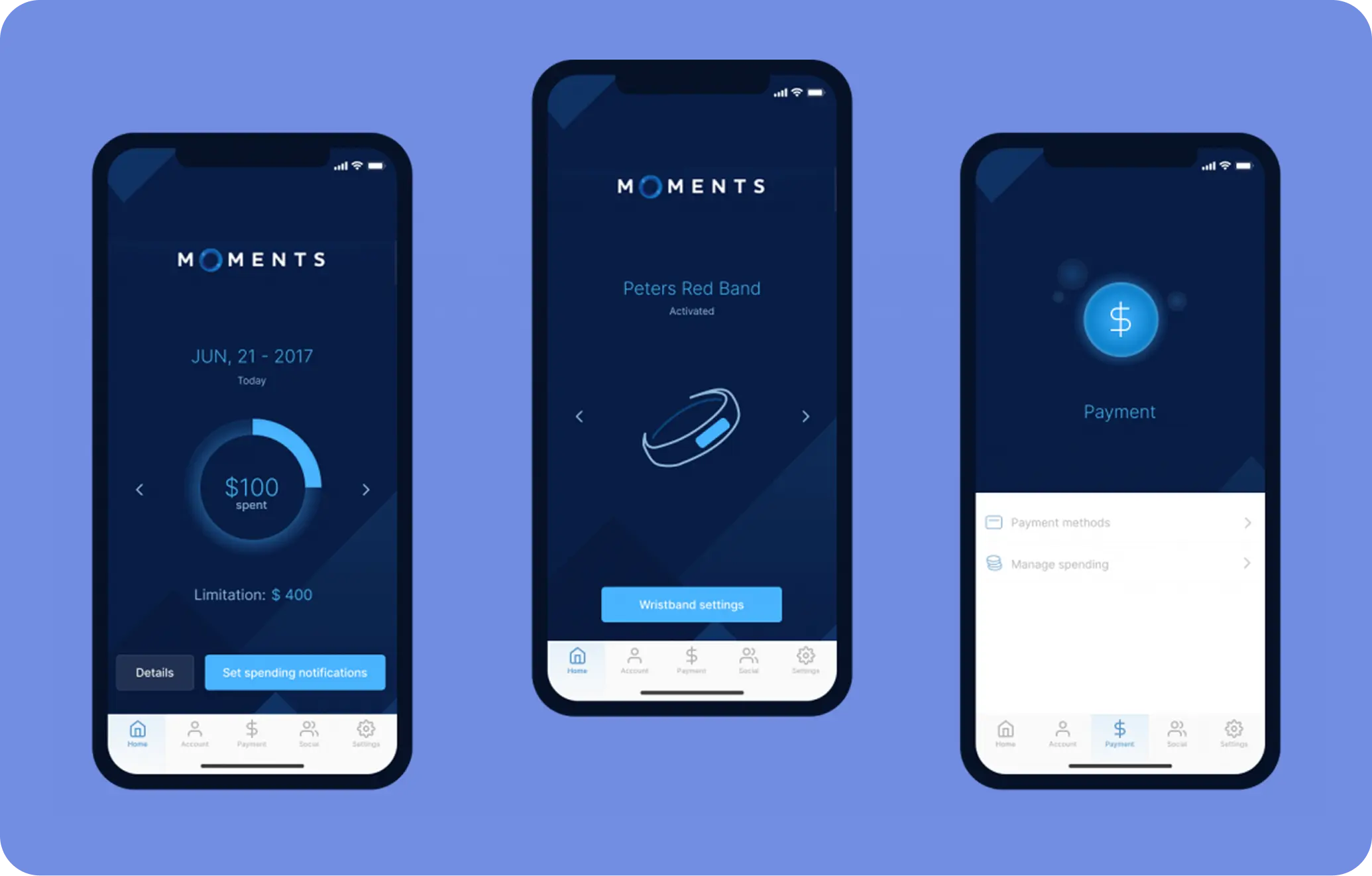

Moments NFC: AI FinTech Startups in Action

Moments NFC lets your patrons pay with a single tap of a wristband, while you collect revenue on any smartphone instead of bulky terminals. In 2017, the founders asked us to prove the concept, pick the fastest gateway, and build an MVP that could scale across U.S. bars.

Scaling mobile fast? Compare the 8 best Ruby on Rails hosting providers for speed and cost.

Challenges

Building a tap-to-pay system for U.S. bars hinged on four critical goals:

Results

Our lean build turned an idea into a revenue-ready platform and gave bar owners data they had never seen before:

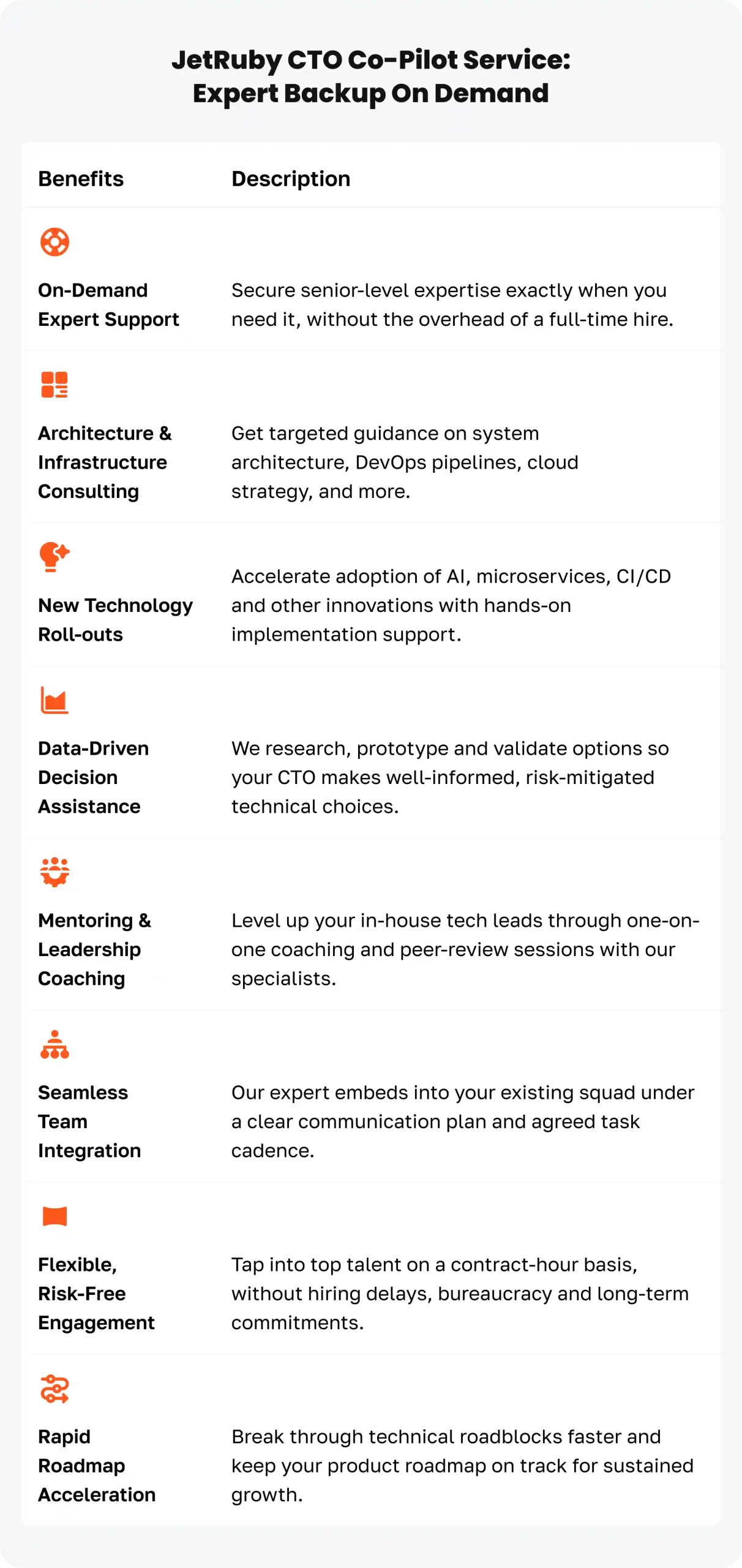

JetRuby CTO Co-Pilot Service: Expert Backup on Demand

When your AI FinTech roadmap demands real-time risk engines, PCI-ready cloud, or fintech AI analytics, our CTO Co-Pilot seamlessly integrates into your team, providing fast, flexible solutions without adding overhead.

An experienced team in fintech artificial intelligence collaborates closely with your experts, patches security or scalability bottlenecks, and shares proven patterns for payments, KYC, and compliance while the internal leader stays in charge.

Pro Tip: If you’re about to hire or upskill a tech leader, read What Is a CTO? Unveiling the Truth About CTO Meaning in Business to set clear expectations.

The service is tailored for AI FinTech startups, SMBs, and large businesses searching for AI for FinTech expertise. Every engagement starts with a brief audit that flags quick wins and hidden risks.

Together we set scope, cost, and timeline, then code shoulder-to-shoulder through each sprint until performance and regulatory metrics hit green. Once the platform runs smoothly, you scale on your own with zero vendor lock-in.

Ready to raise your financial-technology platform to bank-grade standards?

Reach out via our Contact Us form, outline your toughest challenge, and we’ll draft a custom acceleration plan within one business day.