Custom AI for FinTech Development Services

Harness the full power of AI in FinTech to deliver security, automate financial operations, personalize customer service, and make smarter decisions from vast data

Top software development companies

The choice for 200+ companies

Modern Challenges & AI in Fintech Opportunities

Financial technology companies face intense regulations, fast-evolving threats, and sky-high customer expectations. Each challenge is an opportunity for innovation with Artificial Intelligence in FinTech.

Regulatory Compliance Overhead

FinTech teams run KYC/AML checks across regions with time-consuming manual reviews. AI applies computer vision and NLP to verify IDs and monitor real-time transactions while ML flags anomalies, reducing compliance workload and audit risk.

Fraud and Security Threats

Payment fraud and account takeovers morph faster than static rule engines can adapt. ML models score each transaction and user session on the fly, blocking emerging threats and strengthening security with biometric authentication.

Customer Churn and Low Engagement

Users abandon apps that feel generic and frustrating, draining revenue and growth. Predictive models predict customer churn, and personalization engines recommend targeted products or advice, lifting retention and lifetime value.

Data Overload, Missed Insights

Massive streams of transactions and user and market data bury critical risk signals. AI pipelines cluster, classify, and forecast trends, turning raw data into actionable credit, trading, and marketing decisions.

Inefficient Manual Processes

Many financial workflows (loan underwriting, insurance claims, customer onboarding) rely on paperwork and human review, causing delays and errors. Computer vision extracts form data, and ML models evaluate loan eligibility or insurance claims automatically.

Need for Real-Time Decisions

Volatile markets demand instant credit-limit tweaks and portfolio rebalances. Streaming data platforms with ML models can approve transactions, adjust credit limits, or rebalance portfolios on the fly. AI systems monitor live data feeds (stock prices, network activity) and trigger instant alerts or actions.

Scaling Customer Support

As user bases grow, support teams can be overwhelmed by repetitive inquiries about accounts, payments, or technical issues. Conversational AI chatbots and NLP-driven virtual assistants handle password resets, balance queries, and payment disputes 24/7.

JetRuby.Flow

Product Development acceleration with our self-created lean AI-boosted delivery framework

AI PODs

Mature Product teams enhanced by our unique AI agents and DevOps

Tech-business partner

IT Consulting. Strategic audits and advice from mature Architects and Industry Experts

JetRuby’s AI FinTech Development Services

Your organization’s challenges are unique. Our FinTech AI solutions are tailored to your problems, leveraging FinTech and AI best practices like machine learning, computer vision, and NLP techniques.

AI-Driven Fraud Detection Systems

Our AI in Finance solutions stream transactions through anomaly-detection networks and graph models that score risk in milliseconds. We deploy Kafka pipelines, integrate with payment APIs, and surface real-time alerts in custom dashboards to cut chargebacks and fraud losses while protecting customer trust.

Automated Credit Scoring Engines

We train ensemble ML models on credit files, cash-flow data, and alternative sources (open banking, social signals). The platform exposes an API that approves loans in under a second, slashes manual underwriting, and reduces default rates through accurate, bias-free risk scores.

AI-Powered Customer Onboarding

We build KYC/KYB workflows that pair computer-vision OCR with face-match verification and sanctions screening. REST microservices push cleared identities straight into your core system, trimming onboarding time from days to minutes and driving faster revenue capture.

Predictive Analytics & Forecasting

Time-series models and gradient-boosted trees forecast sales, churn, and portfolio risk. Our engineers deliver cloud dashboards (AWS QuickSight, Power BI) that highlight trends and anomalies in real time to help finance teams reprice products, retain customers, predict defaults, and allocate capital with data-driven confidence.

Conversational AI Chatbots & Virtual Assistants

NLU/NLP bots built on Rasa or Azure Cognitive Services integrate with core banking and CRM to answer balances, reset credentials, and route complex tickets. They run 24/7, scale to thousands of concurrent sessions, and cut support costs while improving CSAT scores.

Robo-Advisors & Wealth Platforms

Reinforcement-learning agents and mean-variance optimizers build personalized portfolios, trigger automated rebalancing, and execute trades via broker APIs. Investors gain algorithmic strategies once reserved for quant desks, and platforms grow AUM through superior, low-touch advisory.

Secure Payment Integration & Billing

We engineer PCI-DSS–ready payment modules with tokenization, dynamic permissions, and encrypted Stripe/Bambora flows. Clients launch new billing models (subscription, usage-based, split payments) without security gaps.

Data Engineering & Compliance Architecture

Our teams deploy scalable data lakes on AWS or Azure with lineage tracking, encryption, and audit logging. MLOps pipelines (Kubeflow, Airflow) let data scientists retrain models on demand, while automated policy checks keep every dataset in line with GDPR, SOC 2, and local finance regulations.

Technology Stack & Expertise

We deliver AI-driven financial tools that help business and institutions make smarter lending decisions, reduce fraud, and enhance user engagement in real time.

Programming & AI Frameworks

Data Science

Python

R

Rapid Prototyping

Rails

Flask

React

FastAPI

System Integration

C++

JavaScript

Major ML libraries

TensorFlow

OpenCV

PyTorch

Keras

Scikit-learn

AI Models & Decision Automation

Convolutional Neural Networks (CNNs) for image analysis, Recurrent Neural Networks (LSTM) for time-series forecasting, Random Forests, Gradient Boosting Machines, Support Vector Machines (SVM), K-means clustering, and evolutionary algorithms for task optimization.

Real-Time Processing Data

We engineer robust data pipelines with PostgreSQL, MongoDB, and scalable cloud architectures to support high-frequency transaction environments. Real-time stream processing with Apache Spark, plus secure, scalable REST API integrations ensure seamless system interoperability and compliance.

Smart UI & Embedded AI

From biometric KYC verification using OCR to adaptive robo-advisors with sentiment-aware nudges, our fintech systems are powered by advanced ML pipelines. We deliver multi-platform solutions — from trader terminals to mobile banking apps — with embedded intelligence and explainable AI.

Activate Your Fintech AI Edge

Talk to our financial AI experts, define your objectives, and get a tailored action plan within 48 hours. Transform raw transaction data into smarter risk models, sharper compliance, and deeper customer engagement.

Proven Results & Case Studies

Explore how our AI FinTech development services have powered real-world financial solutions

LinkSquares

AI-powered contract analytics

LinkSquares is a cloud-based platform that uses AI to analyze contracts with speed and precision. It enables full-text searches for phrases, keywords, and terms across thousands of documents in seconds. Trusted by over 10 companies, it has processed over 1 million contracts and secured $7 million in funding

Read more

Moments NFC

A Kotlin-based pub payment app

Our team created a Kotlin app for pub-goers in the USA to let them pay with a simple wave of their hand using NFC technology. The app was built in just 12 days by adapting the existing iOS design, saving the client time and budget. We also delivered a unique mobile application for the Android platform.

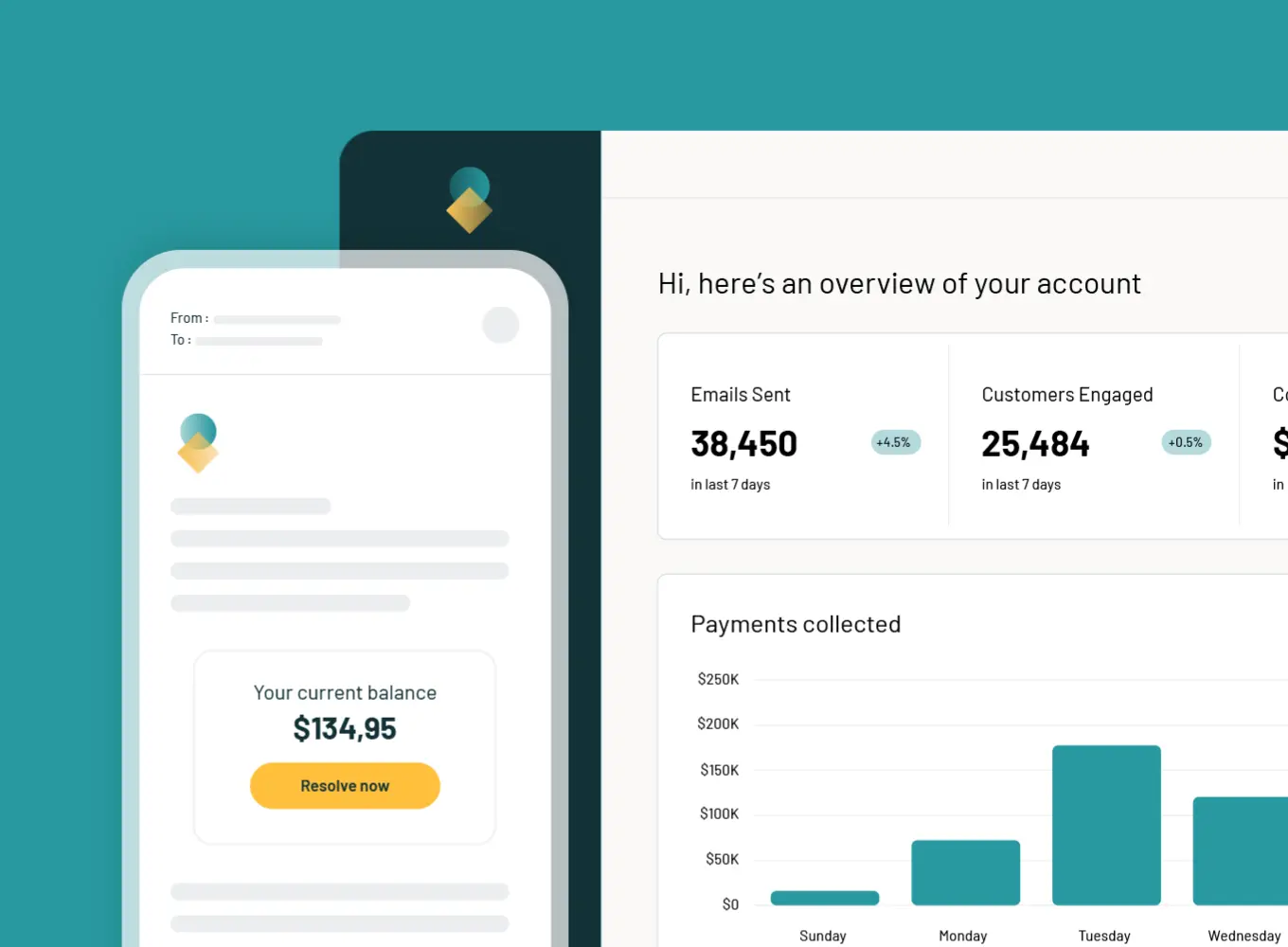

VaultVertex

Digital debt collection made easy

VaultVertex is a Fintech platform that helps businesses manage digital debt collection and payments efficiently. It uses digital reminders to keep customers on track, improving communication and boosting payment recovery. Our team improved the system’s setup, added payment options for a big client, and made the platform more flexible with easier payment agreements and access controls.

Read more

Our AI-driven FinTech Development Process

We follow a transparent, agile process known as JetRuby.Flow, our custom lean delivery system with built-in AI components that accelerates product development. Here’s how our AI FinTech software development company takes your idea from concept to reality.

We start with a deep-dive into your business goals and requirements. Our experts then identify opportunities for AI and define the scope, timeline, and tech stack for your FinTech solution.

Next, we design a robust architecture and an intuitive UX/UI for your product. We plan data flows, select appropriate AI/ML models (e.g., NLP, computer vision), and ensure compliance and security are built into the design from day one.

Our data scientists and developers build and train your system’s AI components while concurrently developing core application features. We use agile iterations and regularly test that AI (fraud detectors, recommendation engines, etc.) works seamlessly within your software and infrastructure.

Before launch, we rigorously test every aspect like functionality, security, AI model performance, and regulatory compliance to refine the machine learning models and software through QA cycles. Then we deploy your FinTech product to production, handling cloud setup, app store releases, or on-premises installation as needed.

After launch, we continuously monitor and optimize the system, gathering real user data to retrain AI models for even better accuracy and adding new feedback-based features. Our team provides ongoing support, maintenance, and AI model tuning to ensure your solution remains cutting-edge and effective.

Financial Businesses We Work With

JetRuby is a FinTech software development agency that understands both the tech and the market. Our expertise spans major FinTech sectors, where we apply AI and ML in financial software development to address each domain’s unique needs.

Digital Banking & Neobanks

We build AI-ready core banking stacks with instant ID verification, budgeting insights, and real-time fraud scoring. Banks launch faster, personalize offers, and match big-bank security without heavyweight legacy costs.

InsurTech

Our CV and ML tools automate claims, flag fraud, and price policies from applicant data. Insurers clear claims in minutes, cut loss ratios, and deliver fair, data-driven coverage for every customer.

WealthTech & Investment Platforms

We embed ML market forecasts, portfolio optimizers, and advisor chatbots into trading apps. Platforms give investors smarter trades and automated rebalances, boosting assets under management and user loyalty.

Payments & Digital Wallets

JetRuby implements PCI-grade gateways, biometric wallets, and AI fraud filters that learn from every swipe. Clients process payments securely at scale, gain real-time spend analytics, and reduce chargebacks.

Lending & Credit Services

Our alt-data credit models and automated origination workflows approve loans in seconds and track borrower risk. Lenders shorten decision cycles, expand safe credit access, and lower default rates through precise AI scoring.

FinTech Startups

We deliver rapid MVPs and scalable, AI-ready products, from digital wallets to crypto exchanges, through flexible fintech solution development packages that accelerate time-to-market and growth.

FAQ

Machine-learning models score every transaction in milliseconds and automate dispute routing, cutting false positives and reducing manual review costs.

You receive a powerful microservice architecture, secure data pipelines, and pre-built model governance so your team can launch AI features without disrupting legacy systems.

Instant KYC checks, personalized product offers, and predictive overdraft alerts typically pay back in under six months by lifting conversions and lowering support volume.

We apply encryption at rest/in transit, role-based access, tokenized test data, and automated lineage tracking so auditors can trace every prediction back to its source.

Use simple controls: keep clear records for each model version, test regularly for bias, log every prediction, and monitor accuracy in real time. Auditors then see exactly how the model works and evolves.

Containerized inference on AWS Fargate or Azure AKS with GPU autoscaling delivers sub-50-ms response times while meeting high-availability SLAs.

CI/CD expands to include feature-store updates, automated retraining jobs, and canary testing for new model versions, all integrated into your current pipelines.

Track first-response time, containment rate, average handle time, and upsell conversion. Successful projects cut support costs by 30 % and raise revenue per user by double digits.